When you borrow a loan from any bank, financial company, or lender, you repay the borrowed amount in the form of monthly instalments. Monthly instalments are deducted in the form of EMI from your account as a scheduled payment. These instalments involve both principal and interest amounts. The terms and conditions of the loan repayment are mentioned in the loan agreement, and it also includes the contracted rate of interest.

What are emergency loans?

An emergency loan is a type of personal loan which can fund any kind of unexpected situation. This loan can be availed the same day or within a few days after the approval from the lender. You can avail of these loans by filling out the online forms and submitting the relevant documents. Most of the time, these loans are unsecured and don’t need any collateral. The interest rate depends on the credit score, relationship with the lender, tenor, and loan amount.

What is a quick loan?

Quick loans are types of short-term loans, advance salary, line of credit, etc. We can choose the suitable option for us just right from our mobile phones. Quick loans are different from the traditional loans we get from banks and financial companies. The lending process is simple and quick, with easy registration and verification. If we meet the eligibility criteria, the funds are transferred immediately to the bank account. We can repay the loan amount with comfortable options chosen by us. In India, most banks have started providing quick loans to fulfil the borrower’s needs. Anyone can avail of quick loans from Non-Banking Financial Companies and Peer-to-Peer lenders apart from the banks.

What is the importance of loan repayment?

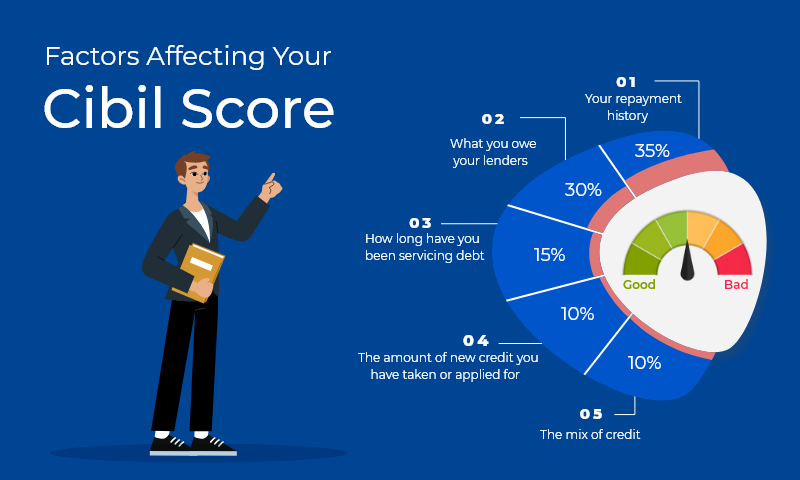

Loan repayment is very important, and anyone should take it seriously. A person should make the payments of any loan on time without any fail because it impacts the credit score if anyone fails to make the payments on time or misses any monthly instalments. Sometimes because of late repayment and missed instalment, the borrower needs to pay bounce charges and late fees charges. It impacts your credit history, and you may face issues in the approval of loans due to a bad credit score.

Which are the loan repayment methods?

The Personal loan repayment method depends on the option chosen by the borrower and it also depends on the type of loan which has been borrowed from the lender. In short, there are two main methods of loan repayment.

- EMIs – EMI stands for Equated Monthly Installments. This is the most popular loan repayment option. Every instalment is a sum of part of the principal and a part of the interest. A monthly instalment is scheduled to be paid every month for a fixed tenor. Some banks and financial companies give the option of pre-paying the loan amount after paying a certain number of instalments. Some banks have the criteria of charging a pre-payment fee if anyone wants to pre-pay the loan. There are two ways to do pre-payment.

- Partial or Part Pre-Payment: When you make the payment of the loan in parts, then your principal amount reduces. This helps you to save the amount of the interest rate because the interest rate applies to the new reduced principal amount.

- Full Pre-Payment or Pre-Closure: When you make the full payment of the remaining loan amount before the loan tenor.

- Bullet Repayment – There is an option of bullet loan repayment to repay the loan on some loan products. In this method, you’ll make the payment of the interest component every month. Once the loan tenor ends, you need to make one bullet repayment which pays off the entire principal loan amount in one go.

Summary

These easy loans and emergency loans are very easy and quick to avail. We need to be careful about the loan repayment so that we can maintain a healthy credit score.

Read Also: 5 Key Principles of Personal Finance