What is a CIBIL score?

Your credit score is regulated by the Credit Information Bureau India Limited (CIBIL), which has direct control over your future contacts with lenders and financial institutions. A good credit score ensures that your loan or credit card application is approved quickly, but a bad credit score jeopardizes your current and future chances. A lack of understanding is the primary reason we can’t always maintain a good credit score. We find ourselves in difficult situations because of our lack of awareness, particularly during difficult times. That’s why, at Bajaj Finserv, we’ve put together a list of five critical traits that can help you develop and maintain a solid financial history.

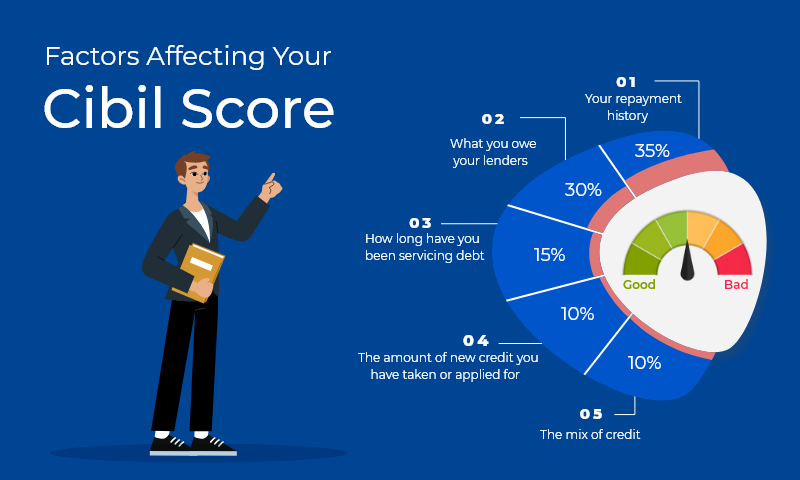

The CIBIL score aids lenders in making their decision regarding whether to provide you a loan. Your credit history, history of loan repayment, debt-to-income ratio, kind of existing loans (secured or unsecured), and prior credit card usage are just a few of the variables that affect your CIBIL score. Find out more about the elements that influence your CIBIL score on Bajaj Finserv markets. We’ll now examine the several additional elements that contribute to my CIBIL score.

Your CIBIL or credit score is impacted by several things, which helps to lower the number. However, the main elements that could affect your credit status are listed below:

Length of credit history:

Your credit history’s age provides a clear indication of how financially sound you are. It indicates that you have had a substantial amount of credit history, which enables the lender to assess your credit management abilities more accurately. However, without an older credit history, it is difficult for lenders to determine your repayment habits. Lenders are likely to hesitate to provide funds under uncertain circumstances.

Credit repayment history:

Your ability to make credit repayments is revealed by your credit repayment history. It is also the main factor considered when calculating your credit score. Your capacity to meticulously satisfy your financial responsibilities by making on-time credit and EMI payments is demonstrated by your payback history. Your credit health is harmed, and your credit score is significantly reduced when you fall behind on credit card payments or do not repay loans within the allotted time.

Credit mix:

The variety of credit accounts you have compared to your loan portfolio has a significant impact on your credit score. The total amount of secured and unsecured credit lines in your name makes up your portfolio. A secured loan is one that is supported by collateral in the form of an asset, as the name suggests. Collateral is used as security for a non-secured loan. Your capacity to effectively handle the various available loan options is demonstrated by your ability to service a mix of loan EMIs and credit card dues. Your credit history is further strengthened, and your profile seems creditworthy as a result.

Credit utilization ratio:

Your desire for credit is indicated by your credit utilisation ratio. It is the proportion between your credit use and the overall credit limit that is accessible to you. The credit bureaus have a bad impression of your profile when you use your credit more than you should. It essentially raises the likelihood that you’ll miss a loan payment. As a rule, keep your credit consumption to between 25 and 30 percent of the credit that has been provided to you.

Not making responsible repayments:

Your credit score is significantly impacted by how you handle the repayments. Make it a practise to pay your credit card and loan bills by the due date. Even a 30-day late payment might lower your score by a significant 100 points. Set up notifications and reminders to make sure you pay your bills on time. When you fail to pay back your credit, lenders see you as a careless borrower.

Will looking up my CIBIL score affect it in any way?

Definitely not! Checking your CIBIL score won’t cost you any points, so don’t be concerned. Is it feasible to restrict or restrict the quantity of difficult queries?

The best course of action is to regularly monitor your CIBIL score before requesting any new credit. By doing this, you’ll be able to predict which banks will approve your credit application. You can always try to improve your CIBIL score if it is low to satisfy your credit criteria.

Additional Read: Factors affecting CIBIL Score for Home Loan.