Before applying for a home loan, make sure to compare the home loan interest rates offered by different banks and NBFCs and know that if you have a decent credit score, you can receive a home loan with the interest rate ranging between 7% and 10% or even lower.

Given that real estate prices have remained flat in recent years, now might be the ideal time for people to invest in the sector. If you are planning to buy a home, there are a few pivotal points you must consider before taking out a home loan. The amount of loan you qualify for is determined by several different criteria, including your present salary and annual gross income. Similarly, borrowers must also hire a financial manager to assess other finer details, such as whether the price of the home they’re considering buying is fair or not, etc.

Purchasing a home can be a once-in-a-lifetime opportunity for the majority of the population. However, not many people can afford to pay the whole value of a home upfront and therefore, most aspiring buyers rely on a home loan to fund the purchase of their home. If you are planning to apply for home loan, read on. Here, we discuss some of the things you must keep in mind while taking a home loan.

Thorough Market Research Is a Must

Conduct thorough market research to find a property that meets your requirements and is within your budget as well as a lender who is willing to extend a home loan offer that works best for you. To get hold of the greatest deals in the market, visit under-construction/finished residences, check online, and speak with property sellers. Having a basic understanding of the real estate market will not only help you save a lot of money but will also help you find the right house for you.

Compare Different Firm’s Home Loan Interest Rates & Charges

If you are planning to take a home loan, the first thing you must do is make sure you can handle a loan. Once you know for sure that you are in a position to handle a loan, the next thing you must do is compare the interest rates being offered by different banks and NBFCs. Even a 0.5 per cent interest rate difference in a house loan might save you lakhs of money. Further, never forget to compare processing, part payment, foreclosure, and other fees as these fees combined together can raise the cost of obtaining a home loan by 1-2 per cent.

Check Your Eligibility For Your Required Home Loan

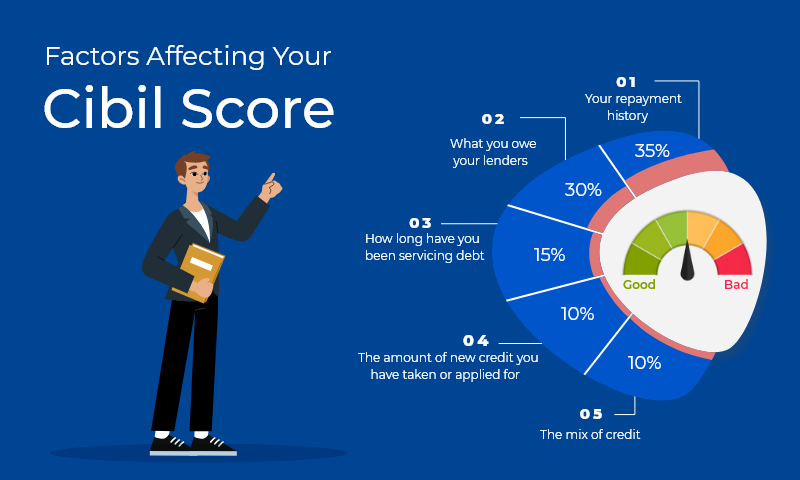

Your final loan amount is determined by your income and previous history of debts. Using an online home loan calculator, you can estimate your eligibility criteria for your preferred home loan. Before applying for a home loan, make sure you meet the eligibility criteria as too many rejected home loan applications can lead to a bad CIBIL score.

Documents Required

You’ll find a comprehensive list of necessary home loan papers and documentation in the application form. All lenders usually keep a copy of a borrower’s identification evidence, proof of income, and proof of residency, bank passbook/bank statement, and applicable property-related papers. Before applying for a loan, gather all of these documents in advance.

Calculation of EMI for the Home Loan

From a borrower’s perspective, EMI (equated monthly payment) is the most common phrase and is the most important factor that drives home loan selections.

Borrowers must make sure their monthly mortgage payment isn’t more than 40-45 per cent of their gross monthly income as anything beyond that certainly becomes an unnecessary financial burden. Further, borrowers must keep the tenor as short as feasible as a longer tenor, though it leads to comfortable EMIs, also becomes the reason for increased total interest outgo.

Before you decide on the loan amount, you must calculate your EMIs in advance and make sure the EMIs you have selected are affordable for you. Use an online home loan calculator, which you can easily find on any aggregator website to understand your EMI obligations and plan your loan repayment in advance.

Consider Opting for a Joint Loan

If you and your spouse are both earning members of the family, you must consider taking a joint home loan as a joint home loan splits the burden of repaying the loan between two people. Furthermore, when one opts for a joint home loan, their chances of being able to avail of a higher home loan amount increase. Borrowers must know that not just husband and wife but also father and son and siblings can avail of a joint loan.

Avail of Benefits Associated with Schemes like Pradhan Mantri Awas Yojana

Under this program, people belonging to certain categories can avail of interest subsidy on their home loan amount. Thus, if you fall under any of the categories defined under the Pradhan Mantri Awas Yojana, make sure to apply to the scheme through your chosen lender.

Decide Between Fixed and Floating Rate of interest

When a borrower opts for the floating interest rate, the interest rate varies depending on the market conditions. On the other hand, in the case of fixed interest rate regime, the interest rate remains constant through the loan tenor. Borrowers must also be aware of the fact that banks and housing finance companies have been prohibited by the Reserve Bank of India (RBI) from imposing prepayment penalties on floating-rate home loans. However, financial institutions can impose prepayment penalties on fixed-rate home loans. Thus, before opting for any home loan interest regime, think and plan well.

Opt for Pre-Payments When Possible

In the beginning, the EMIs that borrowers pay go more towards covering the interest than the principal amount. However, as time advances, the interest component of the loan decreases and the principal component increases. However, one can save on the total interest outgo by making prepayments when possible.

Summing Up

A home loan is a fantastic tool to make your dream of owning a home a reality. However, one must avail of this tool after proper financial planning. Keeping these thumb rules in mind will ensure a satisfying borrowing experience and a financially stable future.